If you purchased a home last year, file your homestead exemption before April 30th to qualify for lower taxes for the property you own and occupy!

If you purchased a home last year, file your homestead exemption before April 30th to qualify for lower taxes for the property you own and occupy!

Mike & Shana Acquisto have more information to help you out!

It seems like everyone’s question this time of year is about the Homestead Exemption. So here are some quick FAQ’s to help you learn more as well as further resources to help you.

Q: Is there a fee to file the Homestead Exemption form?

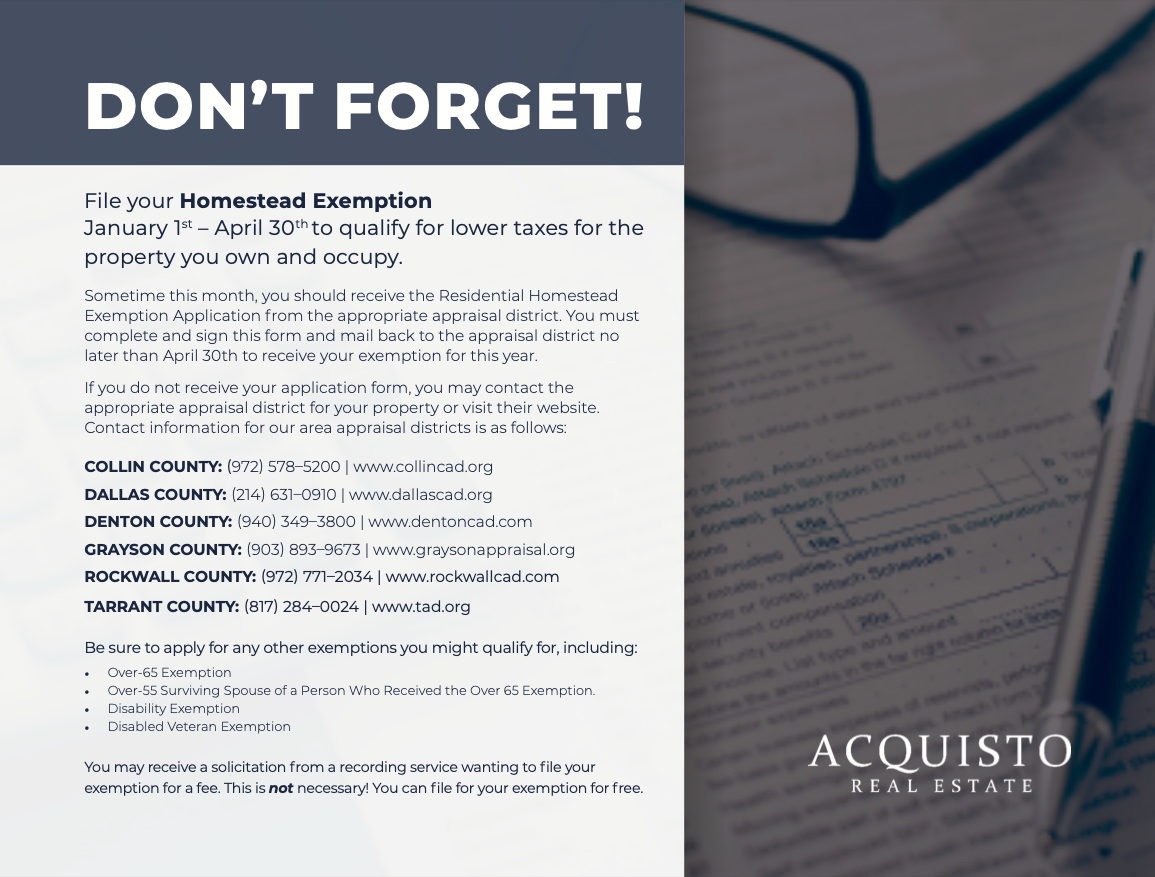

A: There is not a fee to file your Homestead Exemption form. You may receive solicitations wanting to file your Exemption for you for a fee, this is not necessary.

Q: How do I apply for the Homestead Exemption?

A: Each county offers various resources to file for the Homestead Exemption. If you live in Collin County a great website resource can be found here. To download and print the exemption application for Collin County click here. Mail the completed application to: Central Appraisal District of Collin County, 250 W. Eldorado Pkwy, McKinney, TX 75069.

Q: When can I file for the Homestead Exemption?

A: In the case of the general Homestead Exemption you can file your Exemption application between January 1st and April 30th. *Note this deadline may vary based upon the county you own in.

Q: What other exemptions are available?

A: A variety of other exemptions are available to qualified individuals including:

- Over 65 Exemption

- Over 55 Surviving Spouse of a Person Who

- Received the Over 65 Exemption

- Disability Exemption

- Disabled Veteran Exemption

Acquisto Real Estate has prepared a PDF with further information and county resources to help you. If you have any questions please don’t hesitate to reach out to your Acquisto Real Estate agent or broker and we would be happy to help! Click here to download the PDF.

We are here to help! If you have any questions or need more information, feel free to reach out!